Whisper it quietly, but hospitality operators may be looking forward to 2024!

It would be easy to think of the hospitality industry in the UK and Ireland as one on the wane - and recent headlines would often support that viewpoint.

A large serving of optimism could be just around the corner for our sector, however, with nearly half (48%) expecting to increase revenue in 2024. Of course, there are two sides to every story and we certainly cannot ignore the fact that some venues still expect to struggle (10%).

There are still significant challenges to weather after so many years of strife. Costly no-shows, staffing struggles, and rising costs remain on the menu and front of mind for business owners. In the main however, it’s refreshing to see so many venues embrace the year ahead, looking forward to it rather than dreading what’s to come, as they may almost certainly have done in recent years.

As you will read in this report, a significant number of operators opened a new venue last year, and more than a quarter said they are either opening or considering opening another site in 2024. That should mean more jobs, more revenue, and certainly more happy customers.

Indeed, there has also been an increase in diners suggesting they will head out more often - with 36% expecting to enjoy a meal out more regularly this year. So, the ingredients are in place for success, but it will mainly be enjoyed by venues who can deliver value to their diners, and convert them into repeat customers.

As we continue to support ResDiary users, we hope that the insights from this report will guide and strengthen your strategy for the year ahead, and we wish you all the success you can possibly achieve.

- Colin Winning, Chief Executive Officer for ResDiary

Contents and Jump to Section

- What's in the 2024 UK & IE Hospitality Industry report?

- Simmering optimism among operators

- Growth is on the menu

- Diner spend and potential price rises

- Growth section summary

- Protecting revenue and operational efficiency

- Trimming the fat on the menu

- Making the most of opening hours

- The perennial problem of no-shows

- Staffing remains a challenge

- Operation section summary

- Creating a deeper customer connection

- Owning the entire customer experience

- Experience section summary

- Report summary

In this report

The findings in this latest industry report suggest that this year could see the the hospitality sector rebound from a period of sustained turmoil and transition. It would appear that ambitious venues will look to push beyond the old boundaries of the past few years, moving towards better customer experiences and business growth.

First launched in 2023, the Beyond the Booking Hospitality Industry report gives venue owners and operators an opportunity to reflect on the previous year and forecast for 2024. It also discusses the challenges they expect to face as they try to cement their positions and take an even larger slice of the pie in their markets. This first report of 2024 saw 175 people representing venues respond, with a further 595 diners offering their perspectives.

ResDiary has been at the forefront of helping hospitality venues make the most of their table bookings and deliver value from every service since its inception in 2008. By embracing the feedback of diners and restaurateurs in reports such as this, together we can help to ensure success for this year and beyond for our sector.

Download your copy of the full UK & IE Hospitality Industry Report for 2024!

The hospitality industry in numbers

Before we dive into the detail of the findings from our latest hospitality industry survey, let's take a quick look at the key numbers you need to know!

- Nearly half (48%) are expecting 2024 to deliver increased revenue. While just 10% believe their turnover will be lower.

- Comparatively, only 28% believed revenue would increase when asked in 2022 for 2023.

- Those expecting an increase in revenue are predicting turnover to rise by 22% in 2024.

- More than three-quarters of restaurants (76%) were impacted by diners failing to turn up in 2023. 8% of bookings resulted in a no-show. Suggesting there's still work venues must do to protect their revenue.

- Restaurants have fewer vacancies going into 2024, but more than half (53%) are still looking for staff.

- Just under a fifth of operators (18%) opened a new venue in 2023, while 7% permanently closed one.

- 18% of venues were opening their doors more days per week by the end of 2023, compared to just 4% in 2022.

Hospitality Industry Insights 2024 (Expert Analysis)

Simmering optimism among operators

The hospitality industry is one that hasn’t been full of joy in recent years. From the pandemic and everything that brought, to the increased running costs and potential visa barriers preventing foreign workers coming to the UK.

It’s a feeling exacerbated by top restaurants such as Simon Rimmer’s Greens in West Didsbury, Manchester, and MasterChef finalist Tony Rodd’s Copper & Ink in Blackheath, London, both announcing they were closing at the start of the year. The bleak news continued with a report in late February claiming just 41% of leaders in the hospitality industry felt confident about the sector as a whole, with 57% feeling optimistic about their own business’s performance in 2024, which was slightly better, but represented a 5% drop from October 2023.

Another stated closures hit their highest quarterly figure in Q4 of 2023, with 514 restaurants entering insolvency in the final few months of the year, up from the previous high of 481 in Q2 of 2023.

However, despite the negativity - something that cannot be underplayed given that it has been a matter of make or break for so many venues - our research has found the mood and outlook for 2024 are seemingly a lot more positive. With nearly half (48%) of restaurants expecting increased revenue in 2024, there is a real sense of optimism in the industry – particularly compared to the start of 2023, when only 28% responded positively to the same question 12 months ago.

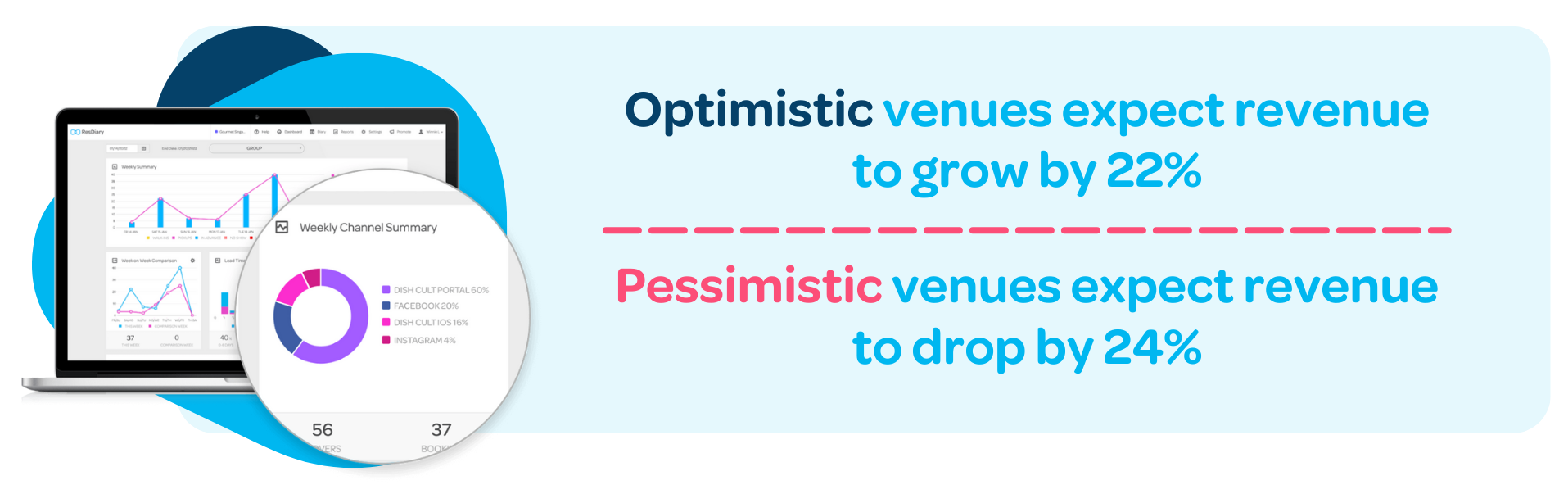

Of the 48% forecasting healthier balance books in 12 months’ time, they expect, on average, a rise in revenue of 22%. That’s up 9% from last year.

This is backed up by over a third (36%) of customers expecting to dine out more regularly this year - that’s after 46% already dined out more in 2023. Only 11% said they’d dine out less this year, which is a slight improvement on the year before (14%). More than half (53%) expect to go out just as much as last year. So, footfall appears to be on a steady and even positive trajectory overall.

Growth is on the menu

With 48% of venues expecting an increase in revenue, just 1 in 10 respondents said they expected turnover to be lower, a significant drop from 34% going into 2023.

Those who are forecasting growth expect an increase in revenue of around 22%, while operators with a less optimistic view envisage a decrease of 24%. So, whichever side of the fence they fall on, we expect this to be a very important year for hospitality businesses. It could also be that this year we’ll see the gap widen between those who push forward and those who may be left behind.

So, with more people planning on heading out and spending what disposable income they have in busy bars and restaurants, venue owners and operators who plan accordingly can rightly be looking to the future with a sense of excitement.

Interestingly, 18% of operators surveyed opened a new venue in 2023, with 14% planning on opening a new site this year, and a further 14% considering doing so – double the 7% figure from 2023.

This trend has been backed up by other third-party reports, with several operators such as Six By Nico, Wagamama and The Alchemist announcing plans to open new sites. But it’s not just UK and Ireland venues that are sensing growth potential in 2024. A survey in the United States found 94% of operators are planning some sort of expansion.

Of course, we can’t ignore the fact that some venues have been forced to close. Our research shows that 7% of businesses permanently closed a venue last year, while a similar number (9%) are suggesting they may permanently shut their doors this year - 3% confirmed they definitely will.

There continue to be challenges to which the industry has to rise, with a string of external forces at play once again in 2024. Increasing revenue may be front-of-mind, but venues will still need to keep tabs on socio-economic influences, like an upcoming election and an economy that teeters to and from recession, and how they might impact their businesses.

Internally, where they have the most control, diligent attention to key data such as booking trends, average spend and operating costs will help them plan for growth while keeping a close eye on the efficiency of their operations.

Diner spend and potential price rises

We know that customers intend to dine out more this year, while having less disposable income was highlighted as the main reason 10% of people said they would dine out less. So, how much are diners willing to spend and how can venues planning prices achieve the right balance?

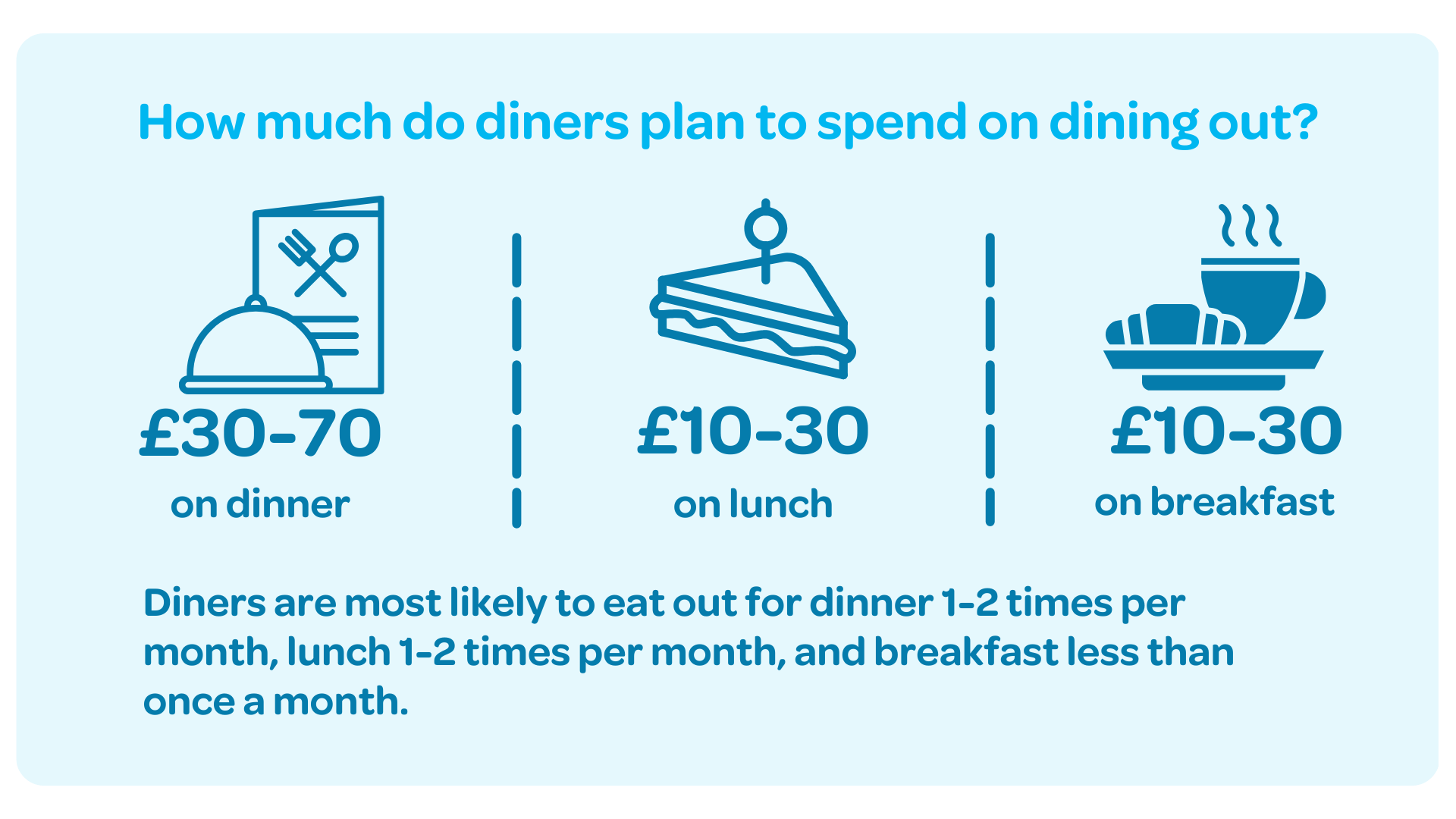

Of the customers who said they will be venturing out to bars and restaurants, more than half (56%) will spend between £30 and £70 on dinner. Most diners said they’re likely to part with between £10 and £30 for their breakfast and lunch on average.

This information may be vital, as nearly 9 out of 10 venues (87%) surveyed said they planned to increase their menu prices this year, a figure that is in line with the 90% that planned to implement rises in 2023. The results suggest venues will increase menu prices by 11% on average in 2024 – again akin to last year.

While bars and restaurants will obviously want to get as much value from every visit as possible, it may be wise to consider your own diner spend data before raising prices to help ensure that you find the right balance of maintaining or increasing your profits without scaring off potential customers.

TAKE ACTION: Share the love with friends and family

The opportunity to spend more time with friends and family was the most common reason for dining out more last year. So, venues should use that to hook in diners who want to catch up over a meal and some delightful drinks. Any effort in tweaking your menu, creating bespoke offers, and delivering tailored marketing campaigns will likely be a worthwhile investment. This is especially true for making the most of special occasions and seasonal events, like birthdays, Mother’s Day, and the festive season.

What this could mean for your business

In a word: growth (hopefully). With more people indicating they plan on dining out in 2024, venues are right to be optimistic for what the year may have in store. Of course, you’ll need to be well prepared to maximise your revenue when opportunities arise.

The majority of diners (56%) have indicated they intend to spend between £30 and £70 on dinner, with half that figure (28%) saying they would likely splash out between £50 and £70. These figures show the market is there. Diners want to get out more, and the spend indication can help venues identify the right price point so they can remain competitive and find value from every visit.

Making the most of your available space and even rethinking dead space could be quick ways of maximising your bookings and unlocking potential revenue. Could your existing space be reorganised to accommodate more tables and could unused areas be used as a drinks reception area? This could encourage people to come earlier and enjoy pre-drinks, cocktails, and bar snacks before their meal.

The same could also be said for extending your opening hours to capitalise on people dining out more. As you’ll find out later in this report, almost a fifth (18%) of venues opened for more days in 2023 than the previous year. Even if you’re not planning on extending your opening hours, you could still assess your revenue per hour and look to maximise quieter times of day. One ResDiary client, for example, found a way to attract more late night bookings (9.30pm onwards), because they knew that these customers tended to spend more on drinks and cocktails, which added tremendous value to their bills.

Learning about your customers and tailoring a bespoke experience should allow you target them with enticing offers for special occasions or even just a catch-up with friends and family. This in turn could help you drive more value from every booking, not just for one visit but for future visits, too. This could extend the lifetime value of every customer exponentially.

Bringing more revenue from every booking will help you grow your business, potentially adding you to the significant number of operators looking to expand in 2024 and beyond. Remember, the gap between those who push forward and those who fall behind may grow this year - based on forecasts from our survey respondents.

Protecting revenue and operational efficiency

Nearly three-quarters of owners and operators (73%) are expecting an increase in the cost of running operations in 2024.

However, while such a significant percentage may trigger alarm, it represents a substantial drop compared to the 93% who envisaged an increase in their costs 2023. That optimism is supported by 22% expecting their costs to stay the same - whereas only 2% expected that to be the case heading into 2023. Those anticipating an increase forecast an average of 21% more in costs in 2024, down slightly from 23% this time last year.

Given the turbulent few years the industry has experienced, this data does paint a different picture in 2024 compared to 2023. Many venues are looking beyond survival (albeit this still remains a necessity) and towards growth. This is evident when comparing the strategic measures taken by them.

Trimming the fat on the menu (while pushing more promotions)

We’ve learned so far that there is optimism and opportunity for the hospitality sector. But that good feeling can only be made tangible by venues playing an active role in attracting diners, enhancing their experience, and optimising operations.

Many are already looking to amplify their customer experience and add value where they can, rather than limiting their options. Where they lead, others should follow.

Among the top tactics our survey respondents have already adopted or expected to adopt was a reduced set menu (67% in 2023). While looking into 2024, turning to events promotions (47% expect to in 2024 ) and special offers (39% expect to in 2024) were also important.

This shows that more venues are now looking to add value to the customer experience, rather than limiting their options and potentially pulling back - it’s likely this is to entice new diners and encourage more visits from existing customers.

TAKE ACTION: Just desserts for diner loyalty?

What more can bars and restaurants do to enhance the experience and improve the chances of repeat visits?

While many patrons of coffee shops, for example, will rack up the stamps on their loyalty cards, it appears to be a decreasing trend for restaurants. There was a significant decline in the number of people who were members of dining-related loyalty programmes or loyalty schemes in 2023, dropping from 49% to a lowly 25%.

However, despite those numbers, other data could indicate a hidden gap in the market for you to capitalise. While 43% of venues surveyed for our Hospitality Tech Trends report agreed they need some sort of loyalty scheme to succeed, 73% of diners said they’d like to be able to earn loyalty points when dining out. These could be exchanged for discounts, special offers, or even a free dessert!

Is there potential value in some form of loyalty scheme for your customers? Only they can answer that question, so why not ask them?

Making the most of opening hours

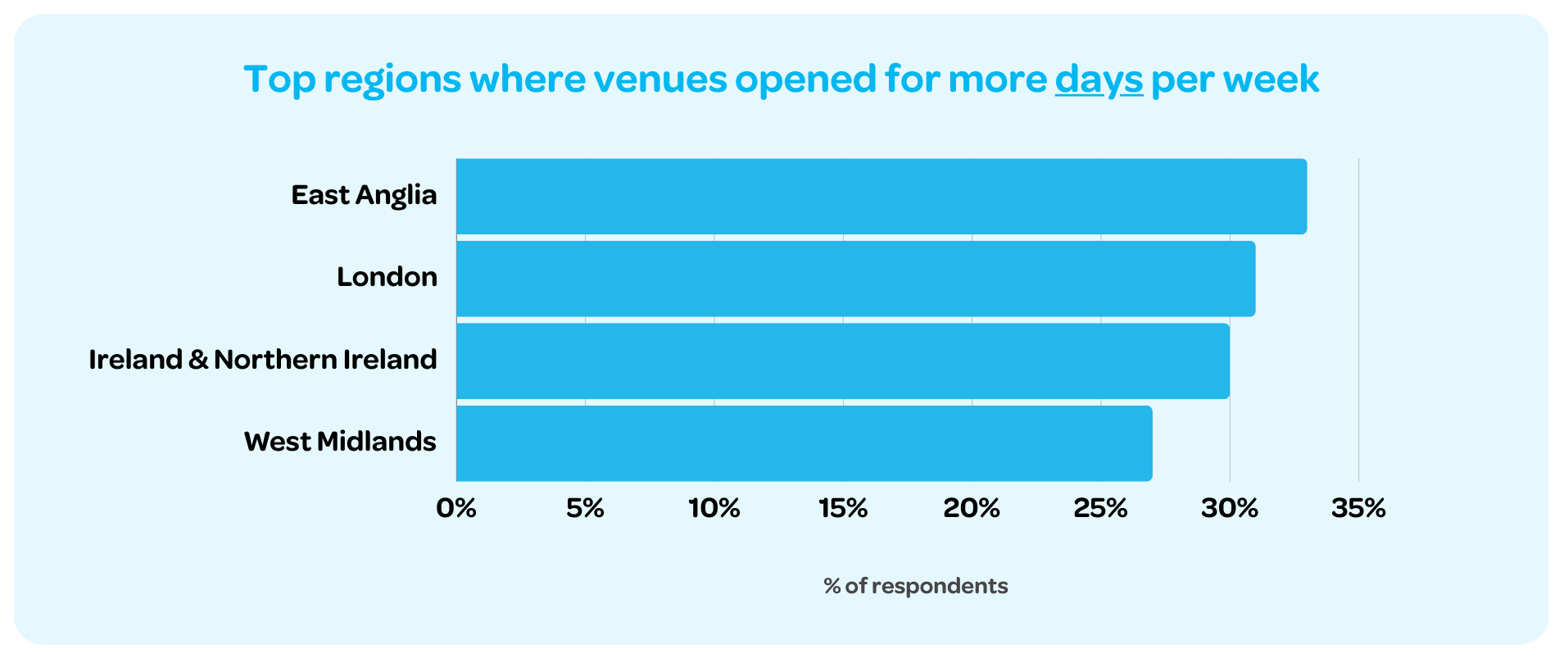

Despite the spectre of increased operating costs still looming large, it is pleasing to see a rise in the number of days venues were open in 2023, with 18% opening their doors more days per week by the end of the year – a steep rise from just 4% in 2022.

There was also a drop in the number of bars and restaurants opening for fewer days (11%), compared to 31% in 2022, yet further evidence of an industry that’s back open for business!

While there were enough customers – and staff – to allow venues in some areas to open more often, conversely there were some that had to limit their opening times. The cost of operations, fewer diners, and staffing challenges all resulted in others opening fewer days in 2023. However, when compared to 2022, a smaller proportion of venues reported these as reasons, which is positive.

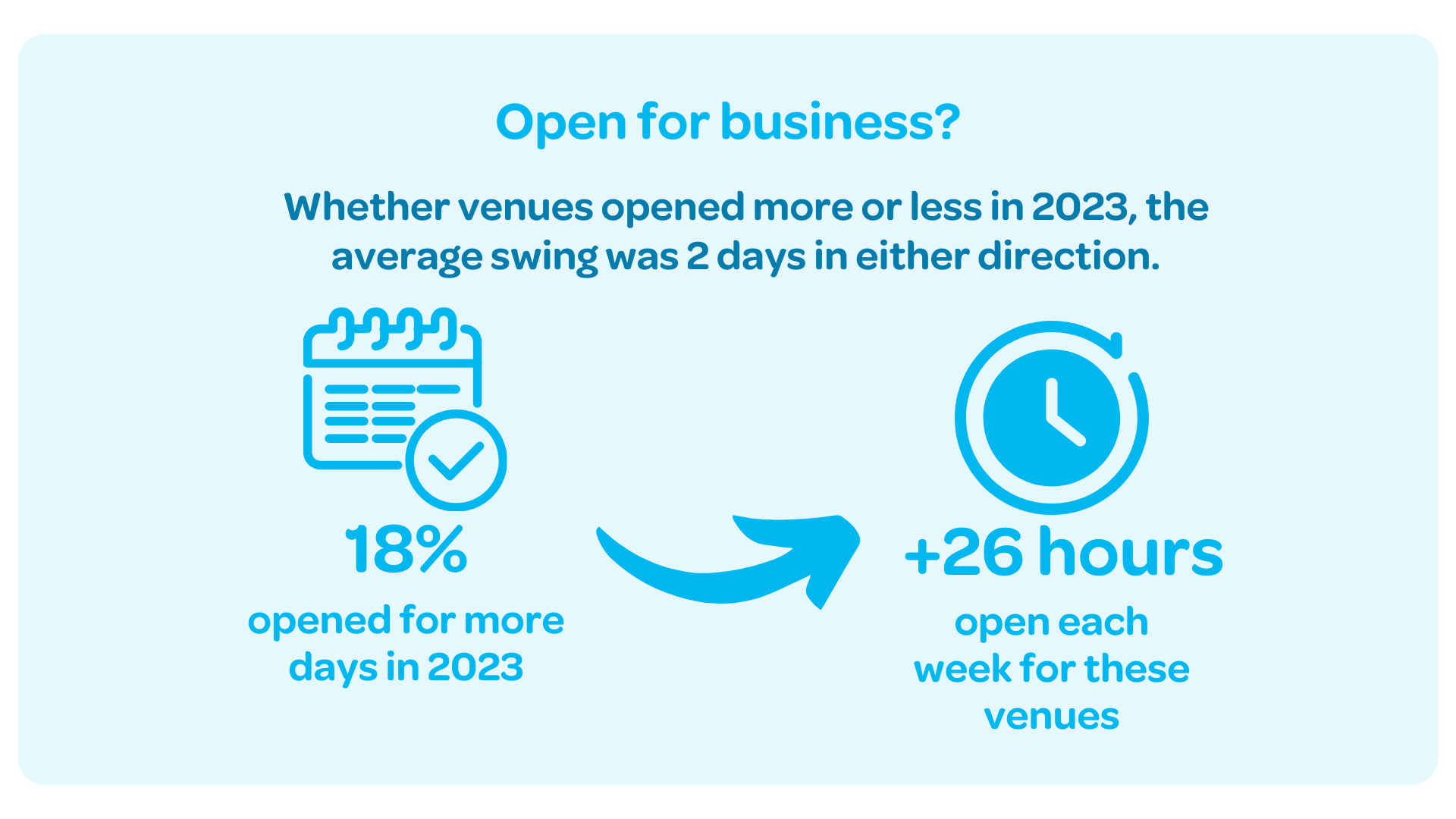

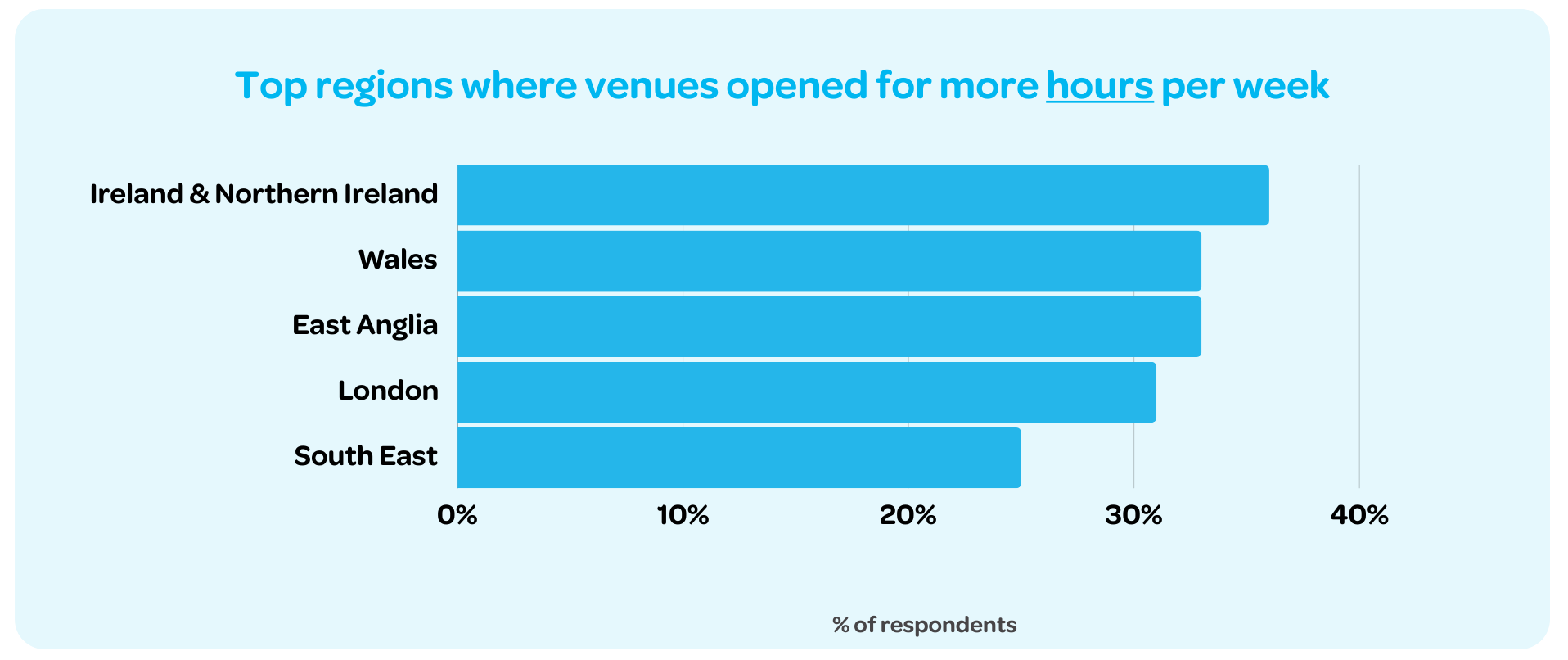

On average, for those establishments that adjusted their operating days, whether opening extra or fewer days, it was a variation of two days in either direction. Among those extending their hours, the average increase was 26 hours per week; that’s more than two extra full days of trading!

While it is clearly positive that nearly one fifth of venues are opening more, the same figure (18%) were open fewer hours, on average 15 hours per week, an increase from five hours in 2022. However, this is a sharp decrease from 2022, coming down from 31%. Conversely, the number of hours-per-week opened remained consistent generally (64%), which again, indicates stability after so much uncertainty in the previous period.

Below, we’ve identified the top regions where venues have either extended the number of days on which they’re open, or they’ve extended their opening hours. This could give you deeper visibility as to what’s happening in your area if you’re located in one of those regions.

By using information from systems such as ResDiary, you can determine the busy (and quiet) times to help inform your decision. As part of any change you make, consider the potential extra revenue you could bring and operational efficiency in equal measure.

The perennial problem of no-shows

While diners showing up at restaurants clearly has a positive effect on a venue’s bottom line, those who book and then don’t turn up are still having the opposite effect, costing valuable revenue.

A whopping 76% of venues were impacted by no-shows last year, with an average of 8% of all bookings not turning up, up from 5% in 2022.

Which regions suffered the most from no-show diners?

-

The North-East of England had the biggest percentage of venues impacted by no-shows in 2023 (91%). The average overall was 76%.

-

The East-Midlands region had the biggest percentage of bookings that resulted in no-shows in 2023 (14%). The average overall was 8%.

-

Ireland & Northern Ireland has the biggest average revenue loss due to no-shows in 2023 (£5,102). The average overall was £3,621.

Get the full low-down on the true cost of no-show diners in your revenue in the full report!

With the average loss in revenue as a result of no-shows totalling £3,621 per venue last year, it is an area where many still need to take action. Interestingly, an increasing number of spots did not require a deposit in 2023 (40% compared to 38% in 2022), but of those that did, the evidence suggests they are getting smart with how it is implemented.

More than half (51%) required a deposit for a certain number of covers – up from 48% in 2022. The average minimum number of covers required to trigger a deposit requirement sits at nine, the same as in 2022. This could suggest venues are being savvier with deposits, with many realising that a blanket rule is potentially putting people off. Of those that are insisting on deposits, there has been a marginal increase in the average cost-per-head of deposits from £12 to £13. It’s something diners appear on-board with after 62% said in our Hospitality Tech Trends report they would be happy handing over their details in order to secure a booking.

TAKE ACTION: Let your booking system handle deposits for you

While the safety of payment details remains a concern for many diners (47% according to our research into tech trends for hospitality), ResDiary allows you to securely store credit card details, apply no-show charges, accept a deposit, or take full payment up-front via Stripe.

Find out more about how restaurants are trying to reduce no-shows

Staffing remains a challenge (but it's looking brighter this year)

Although more than half of restaurants (53%) have vacancies, it is pleasing to see there has been a drop from 2023 when the figure sat at 63%. Another sign that the industry could be heading in the right direction.

Operators we surveyed said hiring or retaining employees is expected to be less of a challenge in 2024, suggesting the staffing crisis, experienced by so many businesses for so many years, could be easing.

Of the vacancies that do exist, on average three are in front of house roles, with two in the back of house; as was the case in 2022. It remains to be seen as to whether this is due to a high turnover of staff as employees leave and venues look to back-fill positions. Alternatively, it could just be a sign of a more stable employee market, with less movement. It’s likely the story will vary from venue to venue.

With that being said, building loyalty will be just as important with your staff as it will be with your customers. Of course, keeping your staff happy and making sure they're supported with the right tools to make their lives easier will always make your workplace a happier, more productive place to be. People join the hospitality industry to delight customers, not manage books, chase deposits, or confirm tables. Anyone who’s done it will know how frustrating it can be!

So, empower them to get out there and show what they can do! You never know; it could be the difference between them staying or leaving, not just your venue, but the sector as a whole.

TAKE ACTION: Use booking data to help plan for your staff needs

A system such as Rotaready not only lets you manage rosters better, it can also integrate with ResDiary’s booking system so you can use booking data and trends to help shape your staffing strategy. Rotaready’s functionality also allows you to produce accurate timesheets and have complete control over labour costs.

Watch the video! Tips for successfully navigating staff shortages

What this could mean for your business

Squeezing more value from every service has always been essential to the success of hospitality venues, but the expected increase of operational expenditure makes it even more critical.

Therefore it has never been more important than now to make the most of the tools you have at your disposal. Optimising operations through automation of tasks (such as table management) and using the data acquired from your tech will only help plan for the future more assuredly, particularly in relation to planning your opening hours if you’re thinking of extending them.

As the Hospitality Tech Trends report said, “the role and importance of integration is growing; almost half (47%) of our respondents said it would be an important factor in determining their tech choices in the future". You’ll want to make sure you don’t get left behind!

Tackling no-shows is an issue that most venues struggle with, and the evidence would suggest that nobody has the perfect solution, but there has been an obvious refinement of methods like deposits and booking reminders - it’s usually a combination of both.

There are tools that can help you to reduce no-shows, with a system such as ResDiary sending automated reminders to those who have booked a table ahead of time. While the majority will show up without the reminder, if they can no longer make it, it can be that prod to remind them to do the courteous thing and cancel so you can resell their table.

The slight decrease in the number of venues requiring a deposit upon booking is a surprising statistic given the clear link between people not turning up and bars and restaurants losing money. Getting the right amount required for a deposit alongside implementing it based on the right circumstances is going to be a substantial saver for venues in 2024. And remember, as has already been pointed out, it could be that simply taking card details and only charging in the event of a no-show is enough!

This could be even more important given the expected increase in operating costs alongside 14% of respondents suggesting they plan to open a new venue this year. With increased opening hours and hopefully an increase in covers, protecting your profits will be critical.

Creating a deeper customer connection

The competition to attract new diners is always fierce. That’s especially true if more businesses are open for longer and opening new venues to boot! Therefore, customer loyalty is critical to success. It all hinges on great experiences.

More than half (53%) of diners surveyed said they consider recommendations from family and friends as the most important factor when choosing where to eat out, which emphasises the importance of delivering a great experience and creating evangelists for your venue.

Ensuring diners, both returning and those coming for the first time, get the best possible experience will help your business achieve sustained growth. After all, making their visit as memorable as possible will increase the chances of further business from them, and their family and friends.

Online, 36% of customers consider reviews, 28% rely on social media, and 34% on search engines, respectively, when researching where to eat. So the spread is fairly even on where people are searching and where your venue should be discoverable. Previous research also showed us that the majority prefer to make reservations digitally too - most diners (93%) booked online in the last 12 months and 81% said it was easier.

More than three-quarters (76%) use the restaurant’s website to secure their table booking, while 64% use third-party booking platforms such as Reserve with Google, Facebook or Instagram, and DesignMyNight.

So, while there is reduced reliance on reviews, taking into account the 72% that decide where to go by the fare on offer, the importance of having up-to-date menus and offers on your website cannot be underestimated.

Owning the entire customer experience

Great bars, restaurants, and hotels are built on the experience they deliver. Whether it is in an Irish pub, swanky wine bar, themed restaurant, or plush high-end silver service venue, people are ultimately looking for a great experience!

This is the key to the hearts of potential long-term customers. Just under two-thirds (62%) said they chose a restaurant based on the experience they would receive, suggesting owners and operators need to think carefully about what makes their dining experience unique or stand out, and then seriously sell it in their marketing.

Perhaps people underestimate how important the booking process is, but it’s where every great experience starts. 40% of people said they will call the venue directly to book a table and 76% said they prefer to reserve on the restaurant’s website. How can these steps be optimised so customers are already excited before they’ve entered your venue? And what happens next?

Let’s dive into the data to discover how you can answer these questions.

Step 1: Booking and pre-arrival

We know that after or even before receiving that recommendation from a friend, diners will research online.

So, make sure those channels are up-to-date with your latest information, like opening hours, menus, and offers. Having a Mother’s Day menu appearing in October is not going to make a good impression or win many new diners!

The majority of people (76%) use a restaurant’s website to book a table, so the power of a slick reservations page cannot be underestimated.

Thankfully, with a reliable booking system such as ResDiary, you can set up your own bespoke booking widget to suit your brand. Once it’s ready, ResDiary does the rest in capturing and managing all your online bookings.

ResDiary also includes a feature for automated phone bookings, so your customers won’t need to keep ringing if they can’t get through.

Check out these examples of amazing booking pages made by ResDiary venues!

Step 2: In your venue

Dazzling them with great service and helping them make the most of their trip to your bar or restaurant should lead to a return visit - not to mention great online reviews!

With any luck, they’ll also spread the word to their other friends and family members. Don’t forget that more than half of diners take recommendations from family and friends.

This is where your service and your operations need to run like clockwork. We’ve talked about reducing unnecessary admin by using tech to automate tasks like booking management and table management.

Having the right information to hand, like booking notes, can also help nurture that experience, especially for special occasions or VIP diners.

All of these will help to ensure your talented team can focus on what they do best - delighting your customers.

Step 3: Post-dining

Now you’ve got booking data that can allow you to build a profile of your customers, which can also allow you to tailor experiences, create special offers, and send bespoke marketing messages to draw them back again and again.

With so many people (72%) saying they dined out for a celebration such as a birthday, the opportunity to turn your venue into their favourite place to celebrate every great occasion, and to turn them into casual diners is one that cannot, and should not, be missed.

Try sending personalised greetings to them ahead of special events or anniversaries or sending them a special offer near their birthday.

While many will see this as a small aspect, perhaps even secondary to attracting new diners, the little things can go a long way for your venues in building long-term relationships that are potentially more valuable.

What this could mean for your business

The idea of providing an experience isn’t necessarily about coming up with new quirky offers or themed events (although these may be excellent ways to draw in new customers). There are many touch-points that make up diner experience, and it all starts with booking.

The results from our latest survey show that offering a great experience is vital - 62% said they chose a restaurant based on the experience they would receive. So, it is important to map out your customer journey from start to finish and consider where your venue is succeeding currently and where there may be gaps to be filled. Remember, that journey starts and ends outside of your venue.

As we’ve mentioned, the right technology - like your booking system, table management system, and customer relationship management (CRM) tools - will make it easier for you to understand your needs and your customers’ needs thanks to their booking data. It will also make it easier for your staff to stay focused on providing a great experience when they’re serving customers.

TAKE ACTION: Tap into the power of a CRM system

These findings from our latest study go to show word of mouth is critical. In business, people buy from people, and that personal touch can be extended through use of CRM technology.

ResDiary includes an internal CRM, while for a more advanced solution, Acteol is helping venues to create a deeper connection with their customers. It could help you increase diner visits and boost your average spend per diner. Plus, it also makes it easier to streamline and optimise your marketing strategy.

Just under three-quarters (72%) of our diners said that celebrations, such as birthdays, was a primary reason for eating out, while seasonal and calendar events such as Christmas (38%) and Mother’s Day (31%) were also important points in the calendar.

When you combine data from your booking system (like ResDiary) with a CRM (like Acteol) you can create customer communications and offers that are way more personalised, and therefore special.

This will boost your venue’s chances of being the first pick the next time a special occasion is due to come up, or you might even give your customers an excuse to come back again before then!

Watch the webinar! Discover how you can boost your business with your booking data

Beyond the Booking: UK & IE Hospitality Industry Report 2024 results summary

That concludes our study into the state of the hospitality industry in the UK and Ireland in 2024, and one thing is clear – there is a quiet hope emerging for the future.

Hope that bars and restaurants will enjoy a more prosperous year, and hope that more people are heading out to enjoy the delights of their favourite venues.

It’s a far cry from the situation the sector has found itself in over the last few years, but certainly does not mean that glory days are already here. There are still a significant number of owners and operators who are fearful of not making ends meet, with some indicating they will close this year.

However, it is pleasing to note that more venues are expecting an increase in revenue, and potentially opening more sites in the year ahead.

Diners will be hoping for memorable experiences when they visit their favourite venues to mark special occasions. And those are also special occasions for venues, who can capitalise on creating long-term customers to drive repeat bookings.

Indeed, more data than ever is being presented to owners, but it’s what they do with it that matters. Data-driven decisions are the norm across many industries, and there is no reason the hospitality sector should be left behind.

Download the full report! Beyond the Booking UK & IE Hospitality Industry Report 2024

We hope this research has given some useful insight and guidance to help your business navigate the year ahead. Our expert team is always on hand should you have any further questions about your needs or you are seeking guidance. You can also save your copy of the full report right here.